Credit Score

Business Credit Score Monitoring

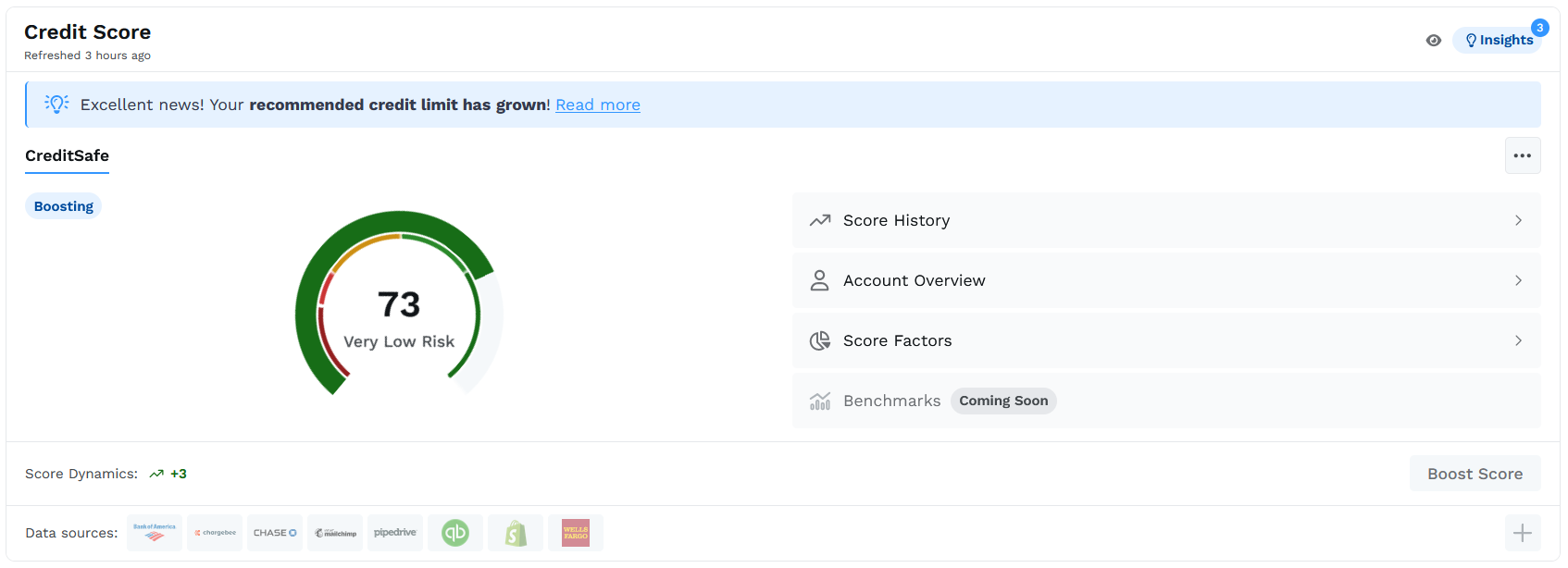

The Credit Score Component is a reliable source of up-to-date information about a user's current credit rating and the key factors affecting it. Moreover, it offers a new way to improve the score. Business owners can safely connect their business apps and bank accounts to supply credit bureaus with real evidence of their creditworthiness.

A business credit score is a metric showing how creditworthy the company is and how likely it is to pay debts on time. This value is based on a corporate credit scoring model, presented in points ranging from 0 to 100 (may vary depending on the bureau).

Data Sources

The business credit score of each individual user is obtained from the credit bureau through a soft credit inquiry. The advantage of such an approach is that it does not affect the actual score (unlike hard inquiry). Soft inquiries are primarily used to verify pre-approval offers or credit checks and are not included in credit score factoring.

upSWOT platform collects business credit score from a selected bureau for a given account by the appropriate bureauId and accountId. These parameters are used in the API requests to get data, which includes a complete credit score history for the 12-month period. The score is updated every 28 days.

Key Features

The widget has built-in, easy-to-use interactive tools that provide a comprehensive view of the user's business credibility, including Score History, Account Overview, and Score Factors. The Score Dynamics are calculated based on the difference between the actual and the previous score and do not relate to a specific date. In addition, the user can download a complete business credit score report in a PDF format offered by the bureau. The report structure may vary depending on the provider, but in general terms, it follows the overall industry standards, offering a glimpse at the company’s credit score, recommended credit limit, and other information.

The user can view their business credit score progress over a 3-6-12 month period by switching the corresponding tabs under the Score History graph, which includes hints explaining score benchmarks. The widget also offers business owners a view of their Recommended Credit Limit, Current Balance, and Amount Overdue on the Account Overview Screen. Finally, the Credit Score Component provides six major factors through a Score Factors screen. Each factor is accompanied by a severity label. However, there is no single industry standard for interpreting score factors. Therefore, different bureaus may look at the information they gather a bit differently, offering their own severity interpretation. In such a case, upSWOT interprets these indicators as they are revealed by each specific bureau.

Note: the Web Component is in demo mode.

Updated 5 months ago